LANSING, Mich. — Michigan College Access Network is working to inform school counselors, college advisers, and other educational partners after the Office of Federal Student Aid (FSA) updated its guidance on the 2024-25 Free Application for Federal Student Aid (FAFSA). The change impacts thousands of Michigan students and families.

FSA’s updated FAFSA guidance now advises students to check the box for “free or reduced-price school lunch” regarding federal benefits only if their annual household income falls below $60,000. The change is meant to align with the U.S. Department of Agriculture income eligibility guidelines. This is a change from previous FSA guidance for states like Michigan, where all public school students receive free lunch through state-level funding and were previously instructed to check the box regardless of income level. The previous guidance has already been provided to counselors, families and students. MCAN is now working to update its network on the change.

“While the creation of the new FAFSA is a welcome improvement for students and families, the rollout of the process by the federal government has been unacceptable,” said Ryan Fewins-Bliss, MCAN executive director. “We understand how frustrating it can be for students and parents to have instructions changed in the middle of the FAFSA application period. We are committed to providing our network with the most up-to-date information and resources available.”

Fewins-Bliss emphasized, “It is vital to Michigan’s future that our students — especially low-income students, first-generation college-going students, and students of color — have access to financial aid that will help them attend college and pursue their career goals. But we believe fewer students will complete their FAFSA and fewer will go to college because of the poor implementation by the federal government, and that is just terrible.”

According to the Federal Student Aid Handbook:

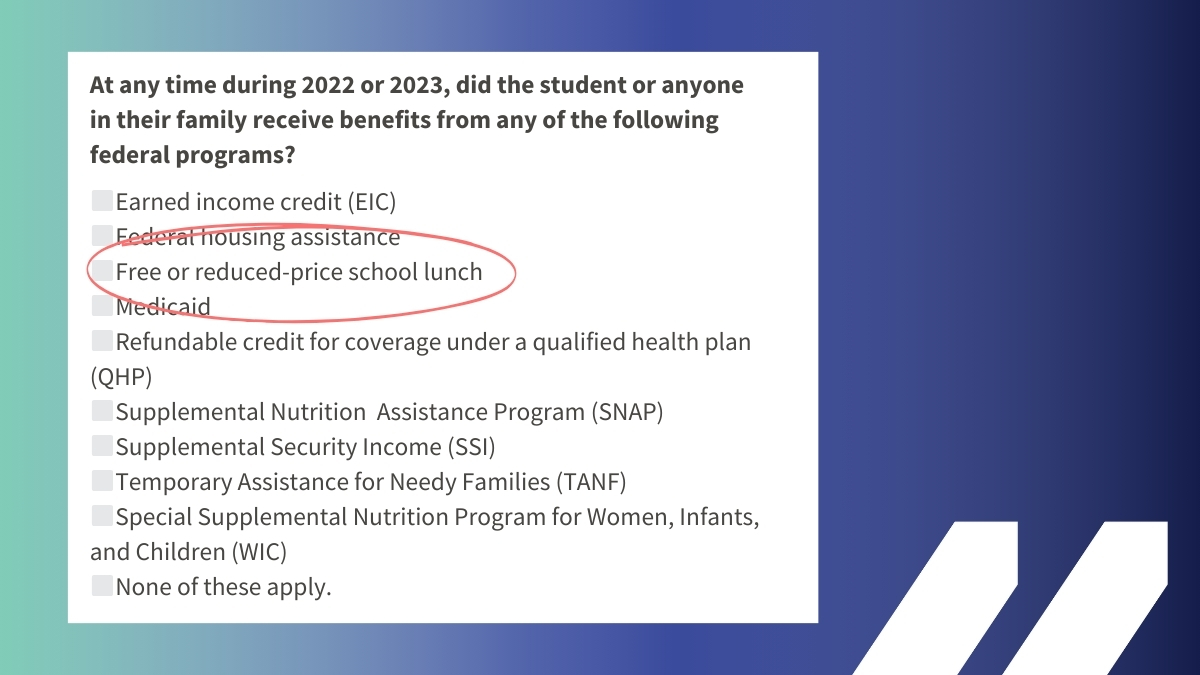

A student may be eligible to have their assets excluded from the SAI calculation if they (or someone in their family) received one (or more) of the following federal benefits during the 2022 or 2023 calendar years.

- Earned income credit (EIC)

- Federal housing assistance

- Free or reduced-price school lunch*

- Medicaid

- Refundable credit for coverage under a qualified health plan (QHP)

- Supplemental Nutrition Assistance Program (SNAP) Supplemental Security Income (SSI)

- Temporary Assistance for Needy Families (TANF)

- Special Supplemental Nutrition Program for Women, Infants, and Children (WIC)

The handbook goes on to state, “*Some individuals may receive free or reduced-price school lunch due to community eligibility rather than household eligibility.”

It’s this asterisk which disproportionately impacts Michiganders. Michigan is one of eight states with free lunch programs available to all students, regardless of income. The new guidance means that families should not check the box for receiving free or reduced-price lunch if they have a household annual income over $60,000, even if they are receiving free school lunch through a Michigan public school. The question is important because those who indicate on the FAFSA they received free or reduced-price lunch can skip several questions about financial assets.

Students who have already submitted their FAFSA are advised to refrain from taking any action and to await further instructions or messages from colleges regarding any changes. For more information on the updated guidance, please refer to NCAN’s website.

Michigan College Access Network is working to inform school counselors, college advisers, and other educational partners after the Office of Federal Student Aid (FSA) updated its guidance on the 2024-25 Free Application for Federal Student Aid (FAFSA). The change impacts thousands of Michigan students and families.